Capital expenditure has always been on the high priority list of every CFO agenda. Globally, the attitude towards capital spending is also taking a leap. The investment decisions regarding CapEx are critical not only because of the size of spend, but also from the point of view of an organization’s strategic goals. It has been observed that most of the time policies or the assumptions for CapEx budgeting and CapEx approval are not very clear in an organization. This article should help better an understanding of industry best practices for capital expenditure planning and considerations behind CapEx polices.

Procurement is one of the crucial parts of CapEx, but is it able to contribute reasonably in the present establishment of CapEx polices in various organizations?

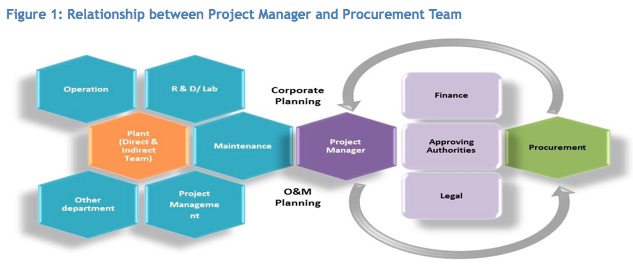

As an age-old convention, organizations have been following very similar practices when it comes to procurement under capital expenditure. The project manager, who is responsible for project execution, would initiate the process as a request for capital expenditure. Usually, he is the one who understands the requirements best. The project manager has to define technical requirements for project, scope of work, project timelines, schedules, contract requirements etc. Only after this, the request has to be sanctioned/approved by the authorized managers to get a final nod for fund allocation. In most organizations, it has been observed that the procurement team gets involved considerably late and contributes only at a tactical level.

This traditional approach is not only time consuming but it also deprives the organization from gaining numerous opportunities to optimize the capital expenditure as well as the CapEx management. As procurement gets involved only at a later stage of the process, it becomes increasingly difficult to bring value to the organization through contract evaluations and negotiations. The major focus for the procurement team remains to minimize the cycle time through quick tactical solutions.

Struggle to manage financial accounting for OpEx (operations expenditures) and CapEx might seem to be the hardest job for organizations, but there are many other challenges in managing CapEx.

The major challenge in the traditional approach for CapEx approval and procurement is its long, slow and inefficient processes with lapses in planning, multiple approvals and repetitive and recurring processes at different sanctioning levels. Organizations are still struggling to manage financial accounting for OpEx and CapEx separately.

Other constraints include unclear definition of approval limits, absence of a comprehensive purchasing policy and guidelines on maintaining retention money, bank guarantees etc., the manner in which project risks/compliances should be captured etc. This also lacks transparency among stakeholders. Isolation of initiator or associated stakeholders such as planning and procurement at an early stage of budget preparation could give a better return in any capital investment. In addition to long approval processes, manual CapEx approvals also increase challenges due to manual errors and underutilization or escalation of budget costs due to lack of transparency.

Return-on-investment is not the only deciding factor for any capital spend; there are many other approving considerations for CapEx.

During planning for capital investments various factors are considered such as nature of project, investment amount, return from investment, short term and long term strategy of the organization, other financial and operational considerations etc. Each capital spend is usually evaluated differently considering if it is for an expansion, regular replacement or maintenance, or if it is to increase efficiency. Different parameters are set basing upon this criteria.

Following are a few key considerations that are needed during project evaluation:

- Key assumptions used in the justification of the project.

- Safety implications, those relating to occupational health issues.

- Details of expenditure which replaces existing assets.

- Basic financial analysis (e.g. discounted cash flow analysis, pay back, ROI etc.)

- Financial justification is normally asked in for specific project types such as modernization/technology upgrade, energy conservation or cost reduction, capacity expansion or de-bottlenecking etc.

- The financial payback to the company relating to the purchase of the particular capital item/project (applicable to the cost reduction/income producing justification category only).

- The amount of sunk costs.

Generally these activities are undertaken during budget planning so as to roll out a workable CapEx budget and avoid unbudgeted capital expenditures. In general, projects worth more than $50,000 need a formal documentation with project code and other details along with a cost benefit analysis from the requester. However, it is prudent to keep records for even small scale projects so as to have a better clarity in accounting. Following is a sample of standard authorization or sanction matrix for capital investment approval:

The project manager is the point of contact for the organization with respect to any questions, issues, reporting (project status, financial status, etc.), that the organization may have during the course of the capital project. Throughout the project the ownership remains with the business head and not the requester or the project manager.In case of new installations, replacement or technology upgrade, disposals of fixed assets must be made in accordance with the organization procedure which should include concerns such as disposal of old assets, rate of depreciation, transfer of fixed assets etc.

Organizations have understood that they need to adopt new approaches and make necessary amendments in existing policies in order to ensure the best results in future.

Most of the leading organizations across various industries are establishing an extensive capital budgeting process that helps in allocating fund directly to the ownership level. Companies are starting to develop and implement effective policy and procedures which not only help in evaluating the financial returns, quantifying values and risk considerations etc. but also would help in bringing transparency in roles and responsibilities. In the new approach, business unit leaders, and not the project manager, are responsible for post-capital outcomes.

Procurement managers are involved at a very early stage such as budgeting and planning unlike the earlier days when procurement managers were only involved in tactical activities. A crossfunction CapEx management committee is created for capital planning and budgeting processes from the very beginning to develop a firm understanding of resource requirements and establish links with each project delivery team member from an early stage. Companies are focusing more on training staff on such areas as TCO (total cost of ownership), reporting requirements, forecasting process, procurement policy and procedures, and more.

For implementing centralized CapEx management process, companies can develop their own models fitting their requirements. However, the success and the sustainability of the policy would highly depend on how well the new policy is knitted into the system. Following are a few action points which would be useful in developing any new policy or methodology for CapEx management:

Action 1: Documentation of guideline and standard procedure. To optimize the process, different business units need to work with the procurement team to develop a common process and procedure for CapEx. Variation and inconsistency in the processes can increase the cost of procurement for the company. Steps such as change order process, order acceptance process, invoice approval process, supplier evaluation process, cost of sales etc. increase the cost of procurement and mostly due to lack of standard guidelines.

Action 2: Crossfunctional team for appraisal and evaluation. Best in class procurement organizations create a cross-functional CapEx committee for appraisal and evaluation of CapEx. Preparing CapEx budget in isolation of procurement, planning or engineering team would never be able to provide the best solution. Involvement of a crossfunctional team as CapEx steering committee would bring various dimensions and numerous opportunities for cost savings. This committee is responsible for project evaluation, analysis, planning, enable the management with the right set of information, so that the management can take an apropos decision.

Action 3: Appropriate project evaluation methodology. The NPV (Net Present Value) method is one of the most common methods for project evaluation. It is also simple to use and eliminates few disparities which are observed while using IRR (Internal Rate of Return) method, such as non-uniqueness of projects and irregular cash flow.In practice, other valuation methods such as accounting hurdle rate, rate of return, payback period and economic value augmentation are used in conjunction with NPV. Payback is normally used to measure some other effects, such as the effect of the project on liquidation.

Apart from financial analysis, project evaluations should also evaluate the risk component attached to the project. Many organizations use a discount rate adjusted with risk characteristic of a particular project or business entity. Real option analysis combined with risk scores is also suggested to keep managerial flexibility where the idea of management ability to intervene in an ongoing project is not ignored.

Action 4: Process automation (e-platforms). E-platforms are available which could improve the CapEx Approval process by structured CapEx requests and approvals integrated with supporting documents and budgets. The project manager initiates all the requests. The originator of the request gets a notification email at each step. If tasks are not completed in specified days, reminder emails are sent out. Managers can approve, reject, or ask for additional information about the authorization request at each stage of the approval. so that every stakeholder is informed about the progress of the request.

An automated CapEx request software solution would be beneficial in achieving the following:

- Increase the speed of the approval process significantly without any manual routing.

- Improve productivity by eliminating system procrastinations and other routing errors.

- Transparency in CapEx requests status (pending approval or completed or rejected).

- Systematic documentation of all processed CapEx requests for later reuse.

- Electronic intimation can ensure CapEx requests meet board approval.

- Ensure process compliance and audit compliances of project.

Action 5: Focus on effective analysis on TCO/Life Cycle Costing (LCC). TCO or LLC analysis is a practice for analyzing all the costs together to streamline the internal aspects of the procurement process and to establish a sustainable procurement policy for the future. To formulate such a procurement policy we need to focus on two major parameters: Cost reduction and Supply chain risk reduction. Ultimately these two levers can help in achieving the primary goal of generating more revenue in organization and improvising internal processes.

Action 6: Regular review for better control and monitoring. To achieve best results from the action points above, there has to be a structured control and monitoring system in place. A periodic review for CapEx project progress would give a better grip over the resource allocation and utilization for project execution.

Organizations, to realize actual benefits out of this initiative, have to toil hard to restructure their age-old practices involved in CapEx approval. Automated workflow for CapEx approval would not only complete the approval process faster but it would also ensure uninterrupted availability of critical infrastructure. Periodic audit trails would provide a tighter control at all stages to prevent complicity and bring more transparency in CapEx procurement. Various ERP software such as SAP, Oracle, Microsoft etc. do provide solutions for process automation. Apart from these, many licensed business process management (BPM) solution providers can develop customized solutions.

To merit the sweets of success, the procurement team has to take the lead role in the organization to bring about this transformation. Early intervention of procurement team for Capex budgeting and planning could bring around 18-20% of cost savings from CapEx procurement. With change management programs, companies can bring best practices into the system. This change is required across all business units of a business entity to realize the specific competitive advantage of CapEx procurement.